Not known Factual Statements About Feie Calculator

Some Known Facts About Feie Calculator.

Table of ContentsFeie Calculator for DummiesAll about Feie CalculatorIndicators on Feie Calculator You Need To KnowWhat Does Feie Calculator Do?The Single Strategy To Use For Feie Calculator

Initially, he offered his united state home to establish his intent to live abroad permanently and looked for a Mexican residency visa with his partner to help satisfy the Authentic Residency Examination. Additionally, Neil safeguarded a long-term building lease in Mexico, with strategies to ultimately buy a building. "I currently have a six-month lease on a house in Mexico that I can expand an additional 6 months, with the intent to acquire a home down there." Nevertheless, Neil points out that purchasing home abroad can be testing without first experiencing the area."We'll most definitely be beyond that. Also if we return to the US for physician's visits or company calls, I question we'll spend greater than thirty days in the US in any provided 12-month period." Neil emphasizes the relevance of stringent monitoring of united state brows through (Physical Presence Test for FEIE). "It's something that individuals require to be really attentive regarding," he states, and suggests expats to be mindful of usual blunders, such as overstaying in the united state

More About Feie Calculator

tax responsibilities. "The reason that united state taxation on around the world income is such a large offer is since lots of people neglect they're still based on U.S. tax obligation also after relocating." The U.S. is just one of the few countries that taxes its citizens despite where they live, suggesting that also if a deportee has no earnings from U.S.

tax obligation return. "The Foreign Tax Credit history enables people operating in high-tax countries like the UK to counter their united state tax obligation by the quantity they've currently paid in taxes abroad," states Lewis. This guarantees that expats are not exhausted two times on the very same earnings. Those in low- or no-tax countries, such as the UAE or Singapore, face added hurdles.

The Ultimate Guide To Feie Calculator

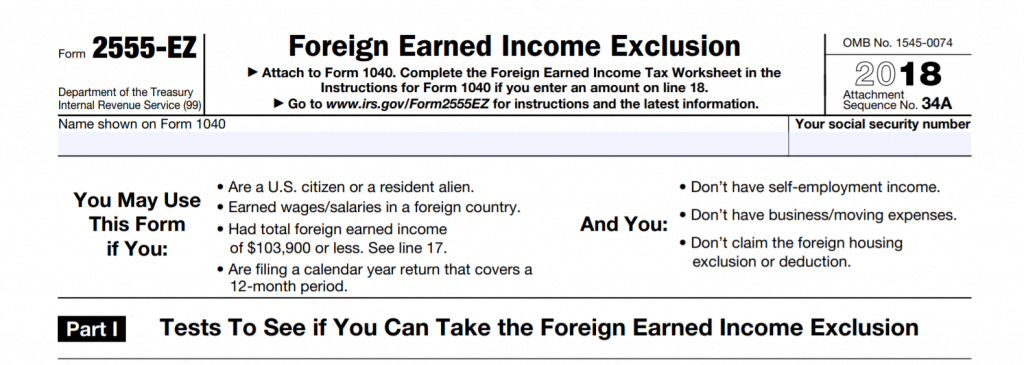

Below are several of the most frequently asked concerns regarding the FEIE and other exemptions The International Earned Revenue Exemption (FEIE) permits U.S. taxpayers to omit approximately $130,000 of foreign-earned revenue from government revenue tax obligation, decreasing their U.S. tax obligation. To get approved for FEIE, you need to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Home Test (confirm your key house in an international nation for a whole tax obligation year).

The Physical Existence Test additionally calls for U.S (Physical Presence Test for FEIE). taxpayers to have both a foreign income and an international tax home.

Getting My Feie Calculator To Work

A revenue tax treaty in between the U.S. and one more country can aid stop double tax. While the Foreign Earned Revenue Exclusion reduces taxable earnings, a treaty might supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a called for filing for U.S. citizens with over $10,000 in foreign economic accounts.

Eligibility for FEIE depends on conference certain residency or physical visibility tests. He has over thirty years of experience and currently specializes in CFO services, equity compensation, copyright taxes, marijuana taxation and divorce associated look at these guys tax/financial planning issues. He is an expat based in Mexico.

The international earned revenue exclusions, occasionally referred to as the Sec. 911 exclusions, leave out tax obligation on salaries gained from working abroad.

Things about Feie Calculator

The tax obligation advantage omits the earnings from tax obligation at bottom tax obligation rates. Previously, the exclusions "came off the top" lowering income topic to tax obligation at the leading tax obligation prices.

These exclusions do not exempt the salaries from US taxation however just give a tax obligation decrease. Keep in mind that a bachelor functioning abroad for all of 2025 who earned concerning $145,000 without various other income will have gross income reduced to absolutely no - effectively the very same answer as being "free of tax." The exclusions are calculated each day.